Project managers are generally not classified under SCA wages.

Are project managers classified under SCA wages? This question often pops up when discussing government contracts and compensation. It’s crucial to understand that the Service Contract Act (SCA) mainly targets blue-collar and service employees.

Project managers usually fall under a different category, focusing on management and planning. Their roles are typically seen as professional, not those directly performing service work. This distinction is key to determining appropriate compensation and legal compliance.

Are Project Managers Classified Under SCA Wages?

The question of whether project managers fall under the Service Contract Act (SCA) wage rules is a tricky one. It’s not a simple yes or no. The answer often depends on the specific job duties of the project manager and the type of contract they are working on. Let’s break it down to understand what’s really going on.

Understanding the Service Contract Act (SCA)

First, let’s get a handle on what the SCA actually is. The Service Contract Act is a U.S. law that applies to government service contracts. It says that contractors and subcontractors working on federal service contracts over $2,500 must pay their service employees at least the local prevailing wages and benefits. These wages and benefits are often set by the Department of Labor and are based on the type of work being done. Think of it like this: if the government hires someone to clean their offices, the government wants to make sure those cleaners get a fair wage, not just any low wage.

The main point of the SCA is to protect the workers who provide services to the government. It makes sure they get fair pay and benefits. But, what exactly is a “service employee”? That is where it can get confusing.

Defining “Service Employee”

The SCA defines a “service employee” as someone who is engaged in performing work for a government service contract. That means their job must directly involve the services being contracted for. It’s not enough for someone to just work for the company that has the contract; their work must directly be involved with the services. There are a few important pieces to this definition:

- Direct Work: The employee must be performing the specific services the contract is for. They can’t be doing a support job that is not directly related to the services.

- Contract Services: The employee’s work must match the type of service listed in the contract. If the contract is for landscaping, the employee needs to be doing the landscaping work.

- Non-Exempt: Generally, the SCA covers non-exempt employees. These are workers who are paid hourly and are entitled to overtime pay when they work over 40 hours in a week.

Project Managers: Service Employees or Not?

Here’s where we get to the heart of the matter. Whether project managers are covered by SCA wages often comes down to their specific job duties. Some project managers might spend the majority of their time doing tasks that aren’t considered “service” work, while other project managers might be deeply involved in the “services” being delivered.

Project Management Activities

Let’s look at the kind of work that project managers typically do. Here are some common tasks:

- Planning: Creating project plans, timelines, and schedules.

- Budgeting: Developing and managing project budgets.

- Team Management: Assigning tasks, monitoring progress, and leading team meetings.

- Risk Management: Identifying potential risks and developing plans to handle them.

- Communication: Keeping stakeholders informed about project progress.

- Problem Solving: Addressing issues that come up during a project.

- Quality Control: Ensuring the project deliverables meet the required standards.

If a project manager’s work involves these tasks as the main part of their role, they might not be considered a “service employee.” Because most of their time isn’t spent actually performing the contracted services, their role is more supervisory and administrative in nature.

When a Project Manager IS a Service Employee

Now, let’s look at situations where project managers could be seen as service employees and therefore could be subject to SCA wage rules. This usually happens when the project manager’s responsibilities go beyond just planning and managing. It often involves hands-on participation in the actual services.

Here are a few examples:

- Technical Projects: Imagine a project manager on a software development project who also writes code, tests software, or provides technical support. In this case, the project manager is not only managing the project but is also contributing directly to the service being provided.

- Healthcare Projects: A project manager working on a healthcare contract may be directly involved in patient care management and may even assist nurses or technicians directly in providing those services.

- Environmental Projects: A project manager working on an environmental project could be involved in field work collecting samples. If they are actively working in the field, they are contributing to the service.

- Training Projects: A project manager on a training project could be involved in developing the training materials and even be the one doing the training. This kind of project manager is both manager and service provider.

In these situations, the project manager’s responsibilities blend into the “services” outlined in the contract, and they are more likely to be considered service employees.

Key Factors in Determining SCA Applicability

To figure out if a project manager should be paid SCA wages, it’s important to look at these factors:

- The Contract Description: What specific services does the contract actually call for? Is it just management of the project or does it involve the actual performance of those services?

- Job Description: What does the project manager’s job description say they do? Does it focus on management and planning or performing services?

- Time Allocation: How does the project manager spend their work day? How much time is spent managing and how much time is spent on hands-on service work?

- Duties Actually Performed: What is the project manager actually doing most of the time? Does the daily work mostly involve management and supervision or are they directly involved in providing the actual service?

The Importance of Time Allocation

A critical factor in this evaluation is the amount of time a project manager spends performing tasks directly related to the “service” portion of the contract versus the management aspect. If a large portion of the day is spent on planning, budgeting, meetings, and other managerial tasks, SCA coverage becomes less likely. However, If most of their time is doing hands-on service work, like the examples above, SCA rules are more likely to apply.

Misclassification Concerns

Companies that don’t fully understand SCA rules might accidentally misclassify project managers. This could lead to serious legal problems and hefty fines. Companies need to do their homework to make sure they’re paying their project managers correctly. Here are some common mistakes companies may make:

- Assuming All Project Managers are Exempt: It’s easy to assume that since project managers have a white-collar role, they’re exempt from SCA rules. This assumption is not always correct.

- Misinterpreting Job Descriptions: The job description might say a project manager does certain tasks, but if they are doing something else, the way the actual tasks are handled matters.

- Ignoring the Contract: It’s vital to look closely at the service contract itself. It should tell you what the services the project manager may be involved in.

- Not Tracking Time Properly: Companies need to track time and how employees are using it. This helps figure out if a project manager is doing service work.

Best Practices for Compliance

Here’s a list of best practices for companies to make sure they are in compliance:

- Review Job Descriptions: Ensure that the job descriptions for project managers are accurate and clearly define the actual duties performed.

- Analyze Contracts: Scrutinize each service contract carefully to understand the exact nature of services being performed.

- Track Time: Develop systems for project managers to track how they spend their time. This will give you the data you need to determine if service work is being done.

- Consult Experts: Seek advice from labor law experts or consultants who specialize in SCA compliance.

- Train Staff: Provide training for HR and management staff on SCA rules and how to classify project managers correctly.

- Audit Regularly: Conduct regular audits of your classifications and wage practices to make sure you stay compliant.

Examples of Project Manager Classifications

Let’s explore a couple of specific scenarios to make things clearer:

Example 1: The Management-Focused Project Manager

Imagine a project manager working on a government project for building a new training facility. This project manager spends most of their day:

- Creating project schedules

- Managing budgets

- Leading team meetings

- Coordinating with construction crews

- Communicating with the government client

In this case, most of the project manager’s day involves management and oversight. They are not directly working in construction or training. This person is probably not considered a “service employee” under the SCA.

Example 2: The Service-Involved Project Manager

Now consider a project manager on a contract to provide on-site training for a government agency. This project manager spends their time:

- Developing training materials

- Delivering training sessions

- Managing training schedules

- Evaluating training effectiveness

- Creating reports on training progress

Here, the project manager does not just plan the training but actually delivers it. They’re involved in the specific “service” of providing the training. This type of project manager is very likely to be considered a service employee under SCA, and would be covered under SCA wages.

Understanding the Wage Determination

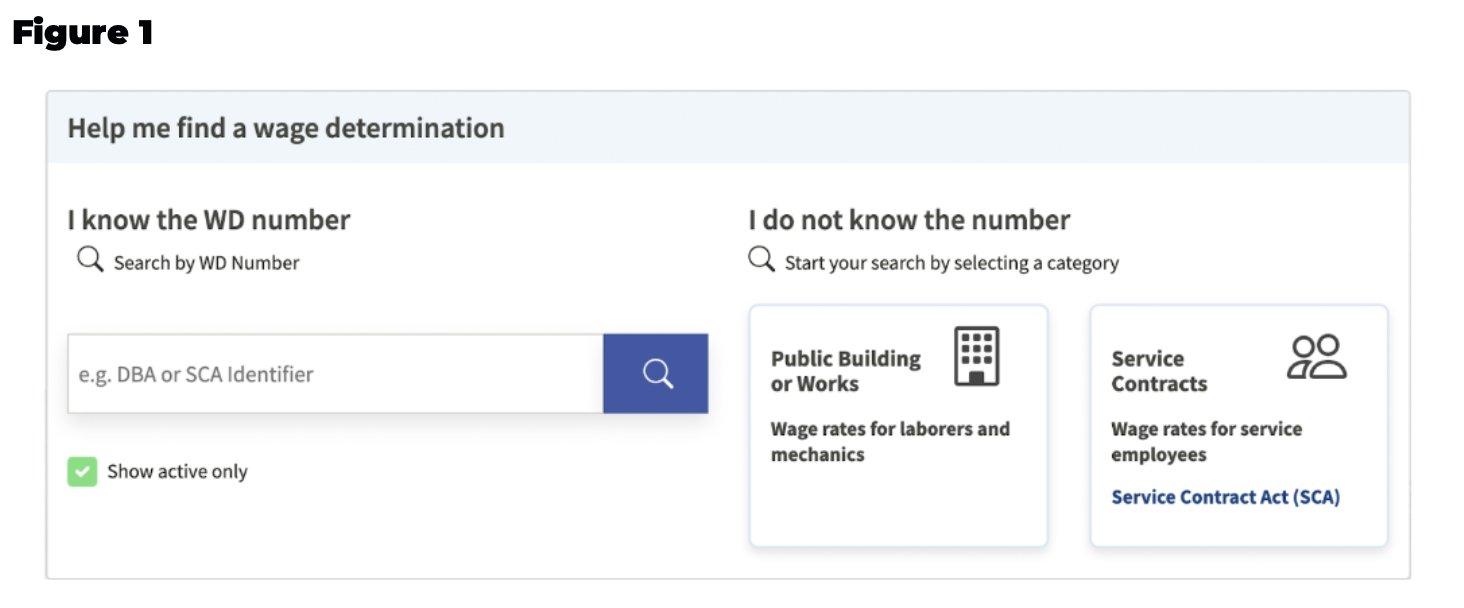

If the project manager is classified as an SCA employee, the employer needs to pay them no less than the SCA wage determination which is a detailed list of minimum wages and benefits for different types of work. The wages are defined for a variety of geographic areas. The wage determination can be found on the Department of Labor’s website. The wage rate is generally determined on a per hour basis. These wages can vary considerably from one geographic location to another.

The Importance of Documentation

Clear and accurate documentation is very important when it comes to complying with SCA. Companies need to keep good records of job descriptions, time spent on different activities, and how they came to their conclusions about SCA applicability. If there’s ever a dispute, clear documentation can help protect a company from legal issues. Having records showing that they made reasonable decisions based on the facts is always helpful.

In the end, figuring out if project managers are covered under SCA wages requires carefully considering their specific job duties and the terms of the service contract. It’s not enough to look just at their title. Companies need to pay close attention to what their project managers actually do and make sure they’re paying them correctly. This way, they can stay compliant with the law and make sure their workers are treated fairly.

Government Contracting – Base Wages

Final Thoughts

Determining if project managers fall under Service Contract Act (SCA) wages depends greatly on the specific contract requirements. The nature of their work and the contract’s stipulations define their classification. This careful evaluation is vital.

Project managers performing duties directly related to covered services might be subject to SCA wage standards. However, managerial roles with higher autonomy often fall outside of its scope. So, are project managers classified under sca wages? It varies significantly based on the contract details and the specific duties performed.