To budget as a project manager, you must accurately estimate costs, allocate funds strategically, track expenses diligently, and adapt your budget as needed throughout the project lifecycle.

Effective project management relies heavily on solid financial planning. It’s not just about hitting deadlines; it’s also about staying within allocated resources. Learning how to budget as a project manager is crucial for success.

This involves understanding all potential costs, from labor to materials, and creating a realistic financial roadmap. Then it is important to maintain that roadmap throughout the course of the project. This skill ensures projects are financially viable and successful.

How to Budget as a Project Manager

Being a project manager is like being the captain of a ship. You guide the project from start to finish, making sure everyone works together and that everything stays on course. A big part of this job? Making sure you don’t run out of money! That’s where budgeting comes in. It might seem tricky at first, but with the right knowledge and some practice, you can become a budgeting whiz. Let’s dive into how you can create a budget that helps your project sail smoothly.

Understanding the Importance of Project Budgeting

Before we jump into the “how,” let’s talk about the “why.” Why is budgeting so important for project managers? Well, a good budget isn’t just about tracking numbers; it’s the foundation for a successful project. Think of it like this: your budget is the roadmap that guides your spending. Without it, your project could get lost or run out of fuel (money!). Here are some key reasons why project budgeting is essential:

- Prevents Overspending: A well-planned budget helps you keep track of your expenses, so you don’t go over what you have available. It’s like having a spending limit for a trip. You want to see all the sights, but you don’t want to run out of money before your vacation is over.

- Sets Realistic Goals: A budget forces you to think through the costs of every task. This process can help you set more realistic timelines and make sure you’re not trying to do too much with too little money.

- Helps with Resource Allocation: Knowing how much money you have available for different parts of the project makes it easier to allocate the right amount of resources where needed. This could be staffing, materials, or tools.

- Keeps Stakeholders Happy: When you have a clear budget, you can show stakeholders (people who care about the project’s success) that you’re managing things carefully. This can build their confidence in you and the project.

- Provides a Baseline for Tracking: A good budget lets you measure how much you’ve spent compared to what you planned. This makes it easier to spot if things are not going according to plan early on.

Breaking Down the Budgeting Process

Now that you know why budgeting is so important, let’s break down the steps involved in creating a solid project budget.

Step 1: Define Your Project Scope

Before you can even think about numbers, you need a clear picture of what your project is all about. This means defining your project’s scope. What are the main objectives? What tasks need to be completed? What are your deliverables? Think of it as building a house. You need to know if it’s a small cabin or a big mansion before you can even start thinking about how much cement you’ll need. A detailed scope statement will help you understand every task involved.

Step 2: Estimate Costs

Now comes the fun part – figuring out how much everything will cost! This isn’t about guessing, it’s about using good information and realistic estimates. Here are some ways you can approach cost estimation:

Types of Costs You’ll Encounter

When estimating costs, keep in mind there are a few main categories:

- Labor Costs: How much will you need to pay your team? This includes salaries, hourly rates, benefits, and any overtime pay. If you have a team working on the project, this is a significant expense.

- Material Costs: This includes the raw materials, supplies, equipment, and other tangible things needed to do the work. If you are making a software, you might need to buy software licenses or other tools.

- Equipment Costs: If you are purchasing or renting equipment that is used on your project, this cost needs to be considered. If you need special cameras, machinery, or tools, this falls into equipment costs.

- Travel Costs: Will you need to travel for the project? This includes flights, accommodation, meals, and transportation. If your team has to visit another city, keep an eye on these costs.

- Subcontractor Costs: If you will hire any external individuals or businesses for tasks, this includes their payments. If you need an expert that your team does not possess, this will be part of your budget.

- Indirect Costs: These costs aren’t tied directly to a specific project activity but are necessary for operations, like rent, utilities, and administrative costs. These need to be considered when thinking about the whole budget for the project.

- Contingency: This is the money that you put aside for unexpected problems. This acts like a safety net. It’s good to add some extra money just in case something unexpected happens.

Cost Estimation Techniques

There are a few techniques that you can use to estimate the costs:

- Analogous Estimating (Top-Down): This involves using the costs from a similar past project as a starting point. It is fast, but less accurate. For instance, if a project of similar scope cost $10,000 last year, you might estimate a similar project will cost around that much.

- Parametric Estimating: This technique involves using statistical data to make cost estimations. For example, if you know it takes two people three hours to produce one report, you can use the number of hours to calculate the total labor cost.

- Bottom-Up Estimating: This involves estimating the cost of each task and then adding all of those together to get the total cost. This is more time-consuming, but more accurate. You’d need to go through every task in the project and figure out how much each task will cost to complete.

- Three-Point Estimating: This takes into account the best-case, worst-case, and most-likely costs and comes up with an average. It gives a range of possible outcomes, not just one number.

Step 3: Create a Budget Breakdown Structure (BBS)

Once you have your estimated costs, it’s helpful to organize them into a Budget Breakdown Structure (BBS). Think of it like a family tree for your expenses. It’s a hierarchical structure that breaks down the total budget into smaller, more manageable parts. Here’s an example of how a BBS might look:

- Project Budget:

- Work Package 1:

- Task 1.1 – Cost Estimate

- Task 1.2 – Cost Estimate

- Task 1.3 – Cost Estimate

- Work Package 2:

- Task 2.1 – Cost Estimate

- Task 2.2 – Cost Estimate

- Task 2.3 – Cost Estimate

- Work Package 3:

- Task 3.1 – Cost Estimate

- Task 3.2 – Cost Estimate

- Task 3.3 – Cost Estimate

- Contingency Fund

- Unexpected Expenses

- Work Package 1:

A BBS makes it easier to see where your money is going and to track spending as you go through the project. You can add as many layers as needed. The key is to have something that makes sense for your project. For a small project, you might have a very simple structure. A bigger project would need a more detailed one.

Step 4: Get Budget Approval

Once you’ve created your budget, it’s time to get it approved by the people who control the project’s funds (stakeholders). You’ll need to present your budget clearly and be ready to explain your cost estimates. Be prepared to answer questions and make adjustments if needed. This could be a meeting where they ask you to clarify some numbers. Be ready to justify your numbers with sound reasons. This is like presenting your business plan to investors, if they believe in your projections and plan, they will be happy to invest.

Step 5: Monitor and Control the Budget

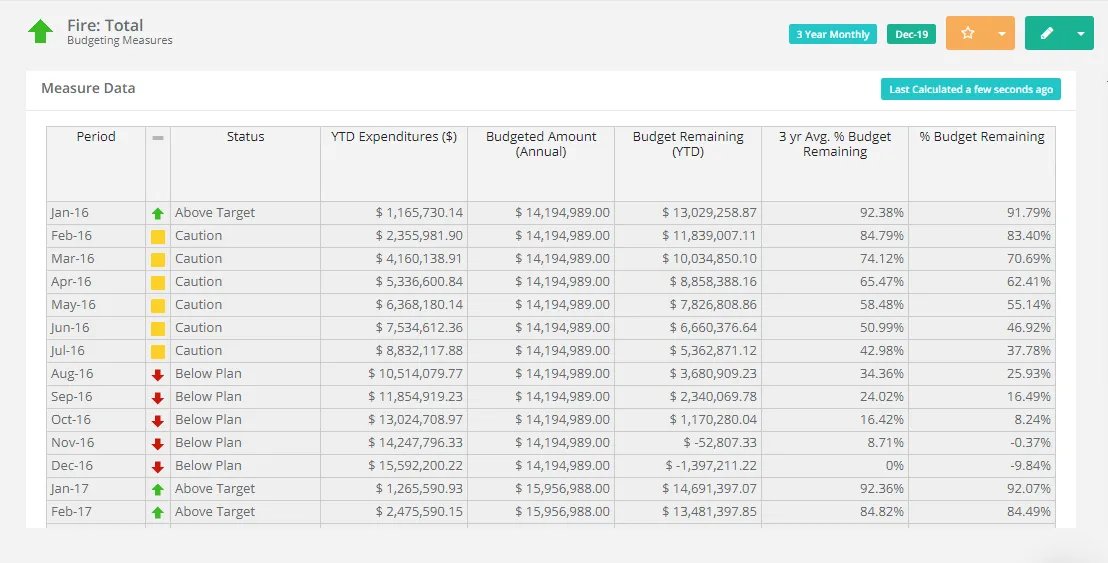

The budgeting process doesn’t stop after the budget gets approved! In fact, that is when the work starts. You need to monitor how your project is doing in terms of its money on an ongoing basis. Keep track of your actual spending compared to your planned budget. Here are the steps to achieve that:

Regular Tracking

Track your spending weekly or even daily if you need. This helps you notice quickly if things are off course. If you wait too long to track the actual cost and expenditure, it will be too late.

Variance Analysis

Compare your planned budget with your actual spending, and investigate big differences. A variance is just the difference between your planned and actual spending. For instance, if you planned to spend $100 on a task but it ended up costing $150, you have a $50 variance. Understanding why these variations happened will help you make sure that the rest of the project stays within budget.

Earned Value Management (EVM)

This is a fancy name for a way to track if you’re getting the value you should be for the amount you’ve spent. It takes into account the planned work, actual spending and actual amount of work completed. It’s like a report card of how the project is doing in terms of spending and value. If the project is spending a lot but not getting much done, it means that you have to adjust the plans.

Adjustments and Revisions

Project budgets rarely stay the same from start to finish. As the project progresses, you’ll likely need to make adjustments and revisions. If you discover a new risk, you might need to revise the budget. When you have to make adjustments, make sure you get those adjustments approved again. Transparency will ensure that everyone is happy.

Tips for Effective Project Budget Management

Managing a budget is not just about knowing the steps but also about adopting good practices. Here are some tips that will make managing your budget more efficient.

Use Project Management Software

Project management software can be your best friend for budgeting. These tools can help you track costs, manage resources, and create reports. Some options include tools like Asana, Trello, Jira, and Microsoft Project. They can make the process much easier and less prone to human errors. Using technology allows you to keep everyone on the same page, access your budget reports quickly, and save time doing it all manually.

Maintain a Contingency Fund

Always include a contingency fund in your budget. This fund is like your safety net. When unexpected things come up, you don’t have to take away from other essential parts of the project. Aim for a contingency that’s about 10% to 20% of your total budget. Think of this as your “just-in-case” money. It is better to have extra money and not use it than to need it and not have it.

Communicate Regularly

Share your budget progress with your team and stakeholders regularly. If something is going wrong, raise your hand quickly. Do not wait for too long to communicate important things. Transparent communication ensures that no one is in dark, and they trust you because of your transparent communication. This way, if you need help or an adjustment, everyone is ready to help and cooperate with you. Also, if the project team knows how the finances are, they might also be more mindful of expenses.

Learn from Each Project

Every project is a learning opportunity. After each project, take time to review how you managed the budget. What went well? What could be improved? Use these lessons to improve your budgeting skills for future projects. Each project will help you get better at managing budgets. Your mistakes can teach you a lot.

Be Realistic

Avoid underestimating the costs. It’s better to aim for a slightly higher estimate than too low. Overly optimistic budgets can easily run over budget and cause big problems in the future. Be realistic with the costs and consider the possibility of some extra spending.

Use Data to Inform Decisions

Don’t just blindly follow your initial plan. Look at the data as you proceed through the project, and be ready to make adjustments based on the latest information. Always use data as the foundation of your decisions, instead of gut feelings. The more you use data to inform your decisions, the more likely you will manage your budgets well.

Budgeting as a project manager is a skill that improves over time. By understanding the process, following these tips, and learning from your experiences, you can become a confident and effective project budget manager. Remember, a good budget is the backbone of a successful project and will give you the ability to finish your project on time and within the given budget.

How to Create a Project Budget

Final Thoughts

Effective budgeting involves careful planning and tracking. Project managers must estimate costs accurately, considering all resources. Regular review of expenses against the budget is essential. These practices enable course correction when needed and keep projects financially sound.

Budgeting as a project manager requires a practical approach. You must prioritize spending, identify potential overruns early, and communicate with stakeholders. Successful project financial management relies on these core practices.