Yes, you absolutely can do project management in finance.

Can you do project management in finance? It’s a question many professionals ponder as they navigate complex financial landscapes. Finance, often seen as solely number-crunching, actually benefits significantly from structured project approaches. Implementing new systems, managing regulatory changes, or launching financial products all need effective planning.

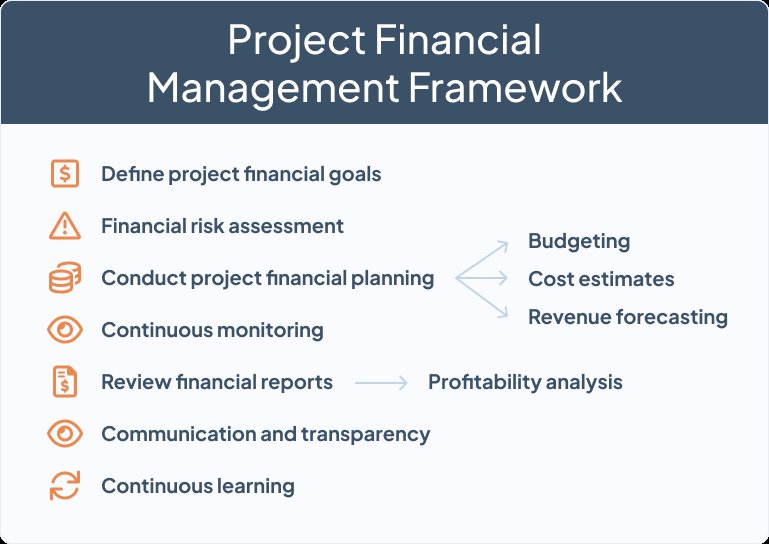

These initiatives require the same core project management skills as any other field such as defining scope, setting timelines and managing resources. Therefore, project management in finance is not only possible but greatly impactful.

Can You Do Project Management in Finance?

Absolutely! When you think of finance, you might picture numbers, spreadsheets, and maybe a stock ticker flashing across a screen. But behind all of that are projects, big and small, that need to be managed carefully. That’s where project management comes in. It’s not just for building houses or launching spaceships; it’s a vital part of making sure financial goals are met successfully.

Why Finance Needs Project Management

Financial institutions and departments face tons of different projects. Think about a bank launching a new online banking platform, an insurance company creating a new policy, or an investment firm developing a new financial product. These aren’t simple tasks; they require planning, organization, and teamwork. Project management provides the structure and tools to handle these complex initiatives.

Specific Needs of Project Management in Finance

Let’s dig a little deeper into why project management is particularly important in finance:

- Regulatory Compliance: Finance is heavily regulated. Any project, like implementing new accounting software or changing customer data policies, must adhere to strict rules. Project managers ensure that all the steps of a project comply with these regulations, avoiding hefty fines and legal issues.

- Risk Management: Financial projects often involve significant risk. A project manager’s job includes identifying potential problems, evaluating their impact, and creating plans to reduce those risks. This could be related to budget overruns, deadlines not being met, or even unexpected market changes.

- Budget Control: Financial projects, by nature, deal with money. Project managers in finance are especially good at making sure the project stays within its agreed-upon budget. They track spending, compare it to the planned amounts, and make adjustments when needed.

- Stakeholder Management: Projects in finance usually involve different stakeholders, from executive leadership to department teams, and even external vendors and clients. Effective communication and clear goals are very important to keep everyone informed and happy with the project’s progress.

- Data Security: In finance, data security is paramount. Project management in this area needs to include very strong data security protocols at every step of a project’s lifecycle. This helps protect sensitive information from getting into the wrong hands.

Types of Projects in Finance

The world of finance has a wide variety of projects. Here are some common examples:

Technology Implementation

These projects involve setting up new software, like:

- Core banking systems: These are the central systems that banks use for daily transactions and record-keeping.

- Trading platforms: These allow traders to buy and sell financial products.

- Financial planning tools: These help clients manage their investments.

Managing these types of projects involves coordinating with IT teams, finance departments, and the end-users, like the bank tellers or financial advisors.

New Product Development

Financial institutions always need to come up with fresh products to offer their clients. This might include:

- New investment funds: These offer clients a chance to invest in certain markets or industries.

- New insurance policies: These provide new coverage options for different needs.

- New loan products: These can include things like personal loans or mortgages.

Project managers help guide these projects from initial idea to launch, involving product teams, marketing teams, and legal departments.

Regulatory Change Projects

New regulations can cause big shifts in the way that financial institutions operate. These projects could include:

- Adapting to new accounting standards: Changes in how companies record their financial results.

- Updating customer identification procedures: Following new rules for preventing money laundering.

- Implementing new data privacy rules: Protecting customers’ private information.

Project managers in this area make sure that all the changes are implemented correctly and on time, and that the business remains compliant.

Mergers and Acquisitions

When companies combine or one company buys another, it requires complex project management. This is an example of a complex undertaking, covering:

- Due diligence: Carefully reviewing the financial details of the involved companies.

- Integration planning: Making sure systems, people, and cultures work well together.

- Operational changes: Changing the day-to-day operations of the combined companies.

Process Improvement Projects

Project managers often work to make existing processes more efficient, cutting costs and making the work easier. This may include:

- Automating manual tasks: Using technology to do tasks that people used to do, saving time and cutting down on errors.

- Re-engineering financial workflows: Making current financial processes more efficient.

- Implementing new reporting systems: Making it easier to track financial performance and make better decisions.

Essential Project Management Skills for Finance Professionals

To be a successful project manager in finance, you need a special mix of skills. These include:

Financial Acumen

You don’t need to be a certified financial planner, but having a good understanding of finance is a big plus. This includes:

- Understanding financial statements: You need to know how to read and use balance sheets, income statements, and cash flow statements.

- Budgeting and forecasting: Good budgeting is necessary for keeping projects on track.

- Financial analysis: This helps you evaluate project costs and benefits.

Technical Skills

Technical skills are required for managing financial projects. These include:

- Project management software: Tools like Microsoft Project, Asana, or Jira are helpful for project planning, tracking, and communication.

- Data analysis tools: Basic proficiency in software like Excel is necessary for analyzing project data and creating reports.

- Financial software and platforms: Being able to navigate the technology that financial institutions use is very useful.

Communication and Interpersonal Skills

Project managers need to be good communicators. This is especially true in finance, where projects involve many different stakeholders. You will need to be good at:

- Active listening: Making sure you understand what different people are saying.

- Clear writing and speaking: Communicating complex ideas in simple terms.

- Conflict resolution: Handling disagreements and finding a compromise.

Organizational and Planning Skills

Being well-organized and able to plan is key to successful project management. Project managers need to be good at:

- Defining scope: Clearly determining the goals and boundaries of the project.

- Creating timelines: Setting realistic timeframes for each phase of the project.

- Resource management: Making sure the project has the people, equipment, and money it needs to succeed.

Risk Management

Identifying and managing risks is a critical part of project management in finance. Project managers should be able to:

- Identify potential risks: Think about what could go wrong with the project.

- Assess risk impact: Figure out how much each risk could affect the project.

- Develop mitigation plans: Create strategies to lessen the negative effects of potential risks.

Project Management Methodologies in Finance

Project managers have different methods that they use to approach project management. Here are a few common methodologies used in the financial industry:

Waterfall

The waterfall method is a traditional way of managing a project. It is a sequential and linear approach. This method is simple to understand and use, especially when the project has a clear set of requirements. Every phase of the project must be finished before moving on to the next one. It is useful for well-defined financial projects where the scope of the project is clear. A project that requires a specific change in a banking system or regulatory compliance updates might be a good candidate for this method.

Agile

Agile is a more flexible approach that emphasizes teamwork and quick adjustments to changes. Agile projects are usually divided into smaller cycles called “sprints,” each sprint involves planning, execution, evaluation, and then adapting to new things. This method is often used when dealing with the implementation of new technologies or products. For example, when creating a new mobile app, or a digital wallet, the requirements are often unclear in the initial phases. Agile can help adapt quickly as the project progresses.

Scrum

Scrum is a particular type of agile project management that employs a structured approach. In Scrum, the projects are managed by the scrum master, the team, and the product owner who works with stakeholders. It employs a time-boxed sprint cycle, with daily standup meetings, sprint planning meetings, reviews, and retrospectives. This works when a financial firm is trying to set up new customer service strategies or working on an upgrade to an existing system, where feedback is gathered frequently during each stage of the process.

Kanban

Kanban is another agile method that is mostly focused on visualizing the flow of the process and limiting work-in-progress. It helps teams keep a focus on a continuous delivery without being constrained by a specific time-box. It has visual boards that show the status of projects as it moves from beginning to end. This method can be helpful when managing ongoing process improvements in a financial department, or in keeping track of tasks involved in regulatory changes that don’t follow a specific sequence.

Tools for Project Management in Finance

Project managers in finance use a variety of tools to get the job done. Here are some essential ones:

- Project Management Software: Tools such as Microsoft Project, Asana, Trello, and Jira, help with project planning, task assignment, and tracking progress.

- Spreadsheet Software: Microsoft Excel or Google Sheets is necessary for budgeting, financial analysis, and reporting.

- Communication Platforms: Tools like Slack, Microsoft Teams, and Zoom help with team communication and collaboration.

- Risk Management Software: Specialized software can assist in identifying and managing project risks.

- Financial Management Software: Tools like SAP or Oracle are used for accounting, financial reporting, and budgeting.

- Time Tracking Software: Applications like Toggl or Clockify are used to track time spent on different project tasks.

Career Paths for Project Managers in Finance

Project management in finance offers great career opportunities, with growth opportunities. Here are some career paths that someone interested in this field might pursue:

Junior Project Manager

This is an entry-level position where you assist senior project managers, and gain experience in project planning, execution, and tracking. Responsibilities include creating project documentation, tracking progress, and helping to coordinate project resources.

Project Manager

Once you have more experience, you can manage your own projects from start to finish. Responsibilities include: developing project plans, leading project teams, and making sure projects stay on budget and on schedule.

Senior Project Manager

In this role, you take on a leadership position, managing big and complex projects, supervising junior project managers, and often, managing several projects at the same time.

Program Manager

This role involves overseeing multiple projects that are linked to one another. Program managers are responsible for strategic planning, coordinating resources, and achieving program goals. You may need to develop the vision for the program and make sure that the projects will meet it.

Project Management Consultant

As a consultant, you’ll provide your expertise to different financial institutions on a project basis. This includes assessments, implementation, training, and process improvement.

In summary, finance can very effectively include project management; it is essential for making sure projects are delivered on time, within budget, and according to all the regulatory requirements. The complex world of financial services greatly relies on project management to help bring about positive results. From implementing new technologies to adhering to strict regulations, financial organizations use project management practices. If you have strong analytical skills, can plan effectively, and have an interest in finance, this is a rewarding and promising career option.

What Project Financial Management? and Role of Finance in Project Management – AIMS Education

Final Thoughts

Yes, project management skills are highly valuable in the finance sector. Complex financial projects, like system implementations or regulatory changes, need organized oversight. Therefore, project managers must apply their skills to achieve successful outcomes.

Financial institutions benefit from structured approaches. They require the planning and execution project management provides. Ultimately, can you do project management in finance? Absolutely, and it is a critical need for many firms.