Managing project financials involves creating a detailed budget, tracking expenses meticulously, forecasting future costs, and regularly reviewing financial performance against the plan.

Ever wondered how projects stay on budget and avoid going belly up? It all boils down to how you handle the money side of things. The question, really, is how do you managing project financials effectively? It’s not magic; it’s a process.

Think of it as a balancing act, ensuring you’re spending wisely and staying within your allocated resources. Good financial management keeps your project afloat, hitting those targets you set out for.

How Do You Manage Project Financials?

Managing project finances is like being the captain of a ship sailing through a sea of costs and budgets. It’s about making sure your project doesn’t run out of money before it reaches its destination. It’s not always easy, but with the right tools and a solid plan, you can steer your project towards financial success. Let’s dive into the key steps involved in keeping your project’s money on track.

Creating a Solid Project Budget

Before you start any project, you need a plan for how much money you’ll spend. This plan is called a budget. Think of it as a roadmap showing all your expenses for the project. A well-made budget is your project’s financial backbone.

Estimating Costs

The first thing to do is to figure out all the costs that will come up during your project. This can be broken down into several areas:

- Labor Costs: How much will you pay people to work on the project? This includes salaries, hourly rates, and any benefits you offer. Estimate time for each task because the more time people spend on tasks the more cost.

- Material Costs: What supplies do you need? Things like tools, software, or anything else you will physically need. Get the price of every material so you get total amount in material cost.

- Equipment Costs: Will you need to rent or buy special equipment? Calculate the cost, also include equipment maintenance, and repair cost if needed.

- Other Expenses: There will be a lot of other expenses like travel cost, training cost, license cost etc. Make a list of all miscellaneous cost to make sure nothing is overlooked.

It’s important to be as detailed as possible when calculating these costs. The more accurate your estimates, the better your budget will be. You can look at past projects to see what these costs were, or get quotes from suppliers.

Setting a Contingency Fund

Even with the best planning, unexpected things can happen. A machine might break down, or some materials might cost more than expected. That’s why it’s very important to set up a contingency fund. This is extra money that you set aside to cover those unplanned expenses. A good rule of thumb is to set aside 5-10% of your total budget for contingency. Having a contingency fund can protect project from budget overruns and help avoid issues that come from unexpected costs.

Getting Project Budget Approved

Once you’ve created your budget, you have to get it approved. This can be by a manager, a client, or some other person in charge. You need to show that your budget is fair and realistic and that there are not any extra or hidden costs. Being open and honest about your budget can help you get it approved faster. When you get your budget approved, that is your financial plan for your project.

Tracking Project Expenses

Once the project starts, it’s important to track every penny you spend. This is how you make sure you’re staying on budget. Tracking expenses involves recording every purchase and cost in the project.

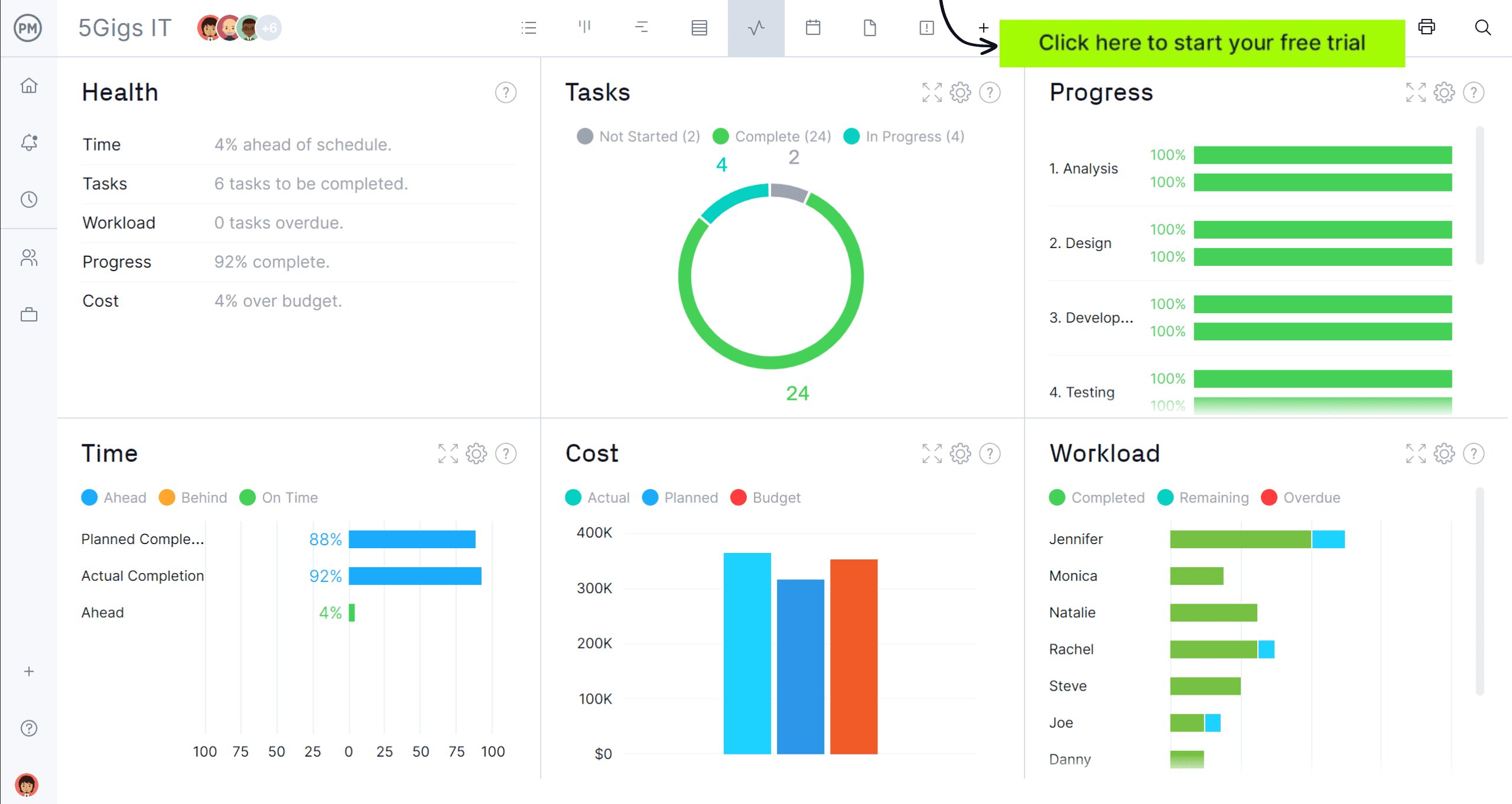

Using Project Management Tools

There are so many helpful tools you can use to track your project expenses. These tools can range from simple spreadsheets to more complex project management software. Here are some options:

- Spreadsheets: Tools like Google Sheets or Microsoft Excel let you create a table to record all expenses and calculate totals. They’re good for smaller projects or for a team that’s comfortable using them. You can use the formulas to automate the calculation and make your tasks easier.

- Project Management Software: Software like Asana, Trello, or Jira are great if you need to track every single activity in project. These are more powerful than spreadsheets and offer tools for tasks and team management, which is really helpful in project management.

- Accounting Software: For a more financial approach, software like QuickBooks or Xero can track spending, and create financial reports. They are more advanced and may be better for larger or complex projects.

Regularly Recording Expenses

It’s important to record all your expenses as soon as they happen. Don’t wait until the end of the month, since you may forget small costs, it might be hard to find receipts, and also the accounting can get messy. Make it a habit to write down costs right away or as soon as possible. Record:

- What was purchased

- The price

- When it was bought

- Who bought it

- What account should it be linked to

The more detailed and timely your records, the easier it will be to know where your money is going.

Reconciling Accounts

Reconciling is simply making sure the money you spent is actually what you recorded. When you receive invoices or credit card statements, compare them to your record to make sure everything matches. This can help you catch errors early and prevent overspending.

Controlling Project Costs

Tracking expenses is really important, but it’s also important to take action when you see the project is going over budget. Controlling cost means adjusting your budget when needed, and making sure that money is being spent wisely.

Analyzing Spending Patterns

Take some time to look at your project’s spending. Do you spend a lot of money in certain places, maybe more than you planned? Are there any repeating or ongoing expenses? Looking closely at where your money is going helps you find areas where you can save more. For example, If you’re spending more than expected on materials, you can search for new vendors that provide materials at low prices.

Identifying Potential Risks

Project risks are things that might cause you to spend more than you planned. Some risks are common in all projects such as scope creep, where extra work gets added to your project, or delays that make projects run longer than initially planned. You can also consider risk associated with people leaving the project or resources becoming unavailable. Knowing about these potential problems helps you prepare and take some actions to control the cost early on before it’s too late.

Making Adjustments

When you find areas where you can reduce your costs, take action and make some changes. This might mean:

- Negotiating with suppliers: You can look for new vendors that are less expensive or can request a discount with existing suppliers if there is chance.

- Changing the project scope: Sometimes, you have to remove unnecessary items to save money, or do a task using a different method.

- Reducing labor costs: This can include adjusting work hours, or finding more efficient ways to get tasks done, but you have to make sure project timeline should not be impacted.

It’s important to adjust the budget when needed, being flexible in project, and take the required actions to make sure that project stays on track financially.

Forecasting Project Finances

Looking ahead and planning for the future is just as important as tracking the current money. Forecasting is a way of predicting how the project’s money will look in the future. It is also important for making the right decision and ensuring a project’s success.

Project Cash Flow Projection

Cash flow projection is a look at how money will move in and out of a project over time. It shows you when you will receive payments, and when you will need to pay bills. A project cash flow shows whether the project will have enough money to pay for all its costs and helps you make sure project won’t run out of money.

- Calculate expected income: List when you will receive payments and the exact amount.

- Calculate expected expenses: List when you have to pay bills and the exact amount.

- Track the difference: Compare the income and expenses to see whether you will have a positive or negative cash flow in future.

Cash flow projection can show if you may run out of money in the future and allow you to prepare.

Analyzing Financial Performance

Regularly assess your project’s financial health by looking at key performance indicators (KPIs). Some common KPIs are:

- Cost Variance: This measures the difference between the planned costs and the actual costs, telling you if you are over or under budget.

- Schedule Variance: This looks at whether the project is ahead or behind schedule. Delays will also result in increased costs, so this is important to track.

- Return on Investment (ROI): This measure how much money the project is making compared to how much was spent on it.

Regularly look at these financial metrics to see how the project is doing. If some of the numbers aren’t what you want them to be, it’s time to take a deeper look and adjust accordingly.

Communicating Financial Status

It is important to keep everyone involved in the project informed about the financial status. This includes people in team, managers, and also clients. When everyone knows about the current financial status of project, that will help them make informed decisions and take appropriate action if needed. Be open and honest about the project finances. Regular communication will build confidence and trust among all stakeholders.

Documenting Financial Activities

Properly documenting all the financial transactions is important for a number of reasons. It not only helps you stay organized but also provides a complete record of how money was handled in the project.

Maintaining Receipts and Invoices

Keep every receipt and invoice, they are proof of every transaction. File all receipts properly, whether in digital or physical form. This will help you to track expenses, and also makes it easy for you to reconcile the accounts. If receipts are saved properly then you don’t need to search everywhere for them and you will always know where each receipt is saved. If you have the original receipt it will be easier for you to claim the tax benefit at the end of the year.

Creating Financial Reports

Create financial reports throughout the project, not just at the end of project. These reports summarize all project’s financial activities and help you see the overall health of the project finances. Some of the financial reports are:

- Budget vs Actual Report: This report compares the budgeted costs and the actual spending.

- Expense Report: This report details all the expenses made in project.

- Cash Flow Report: This report shows how much money has come in and out of project over time.

These reports are really helpful in tracking the financial health of a project and to make better decisions.

Auditing Project Finances

Auditing involves a review of all financial records to ensure the spending was done correctly. You can also hire someone or a group of experts to do this, especially in larger projects, where there are more complex transactions involved. Auditing helps maintain the accuracy and transparency of project’s financial transactions.

Managing project finances is important for every project. From creating a budget to tracking every expense, controlling costs, and finally documenting everything, it all comes together to ensure the project finishes successfully and stays on budget. By focusing on the basic things mentioned above, you can steer your project toward financial success and meet the overall goals of the project.

Project Financial Management – 5 Tips for Good Project Cost Control

Final Thoughts

Effective project financials hinge on clear budgeting, diligent tracking, and proactive adjustments. We monitor expenses closely against the initial plan. Regular financial reviews help identify potential overruns early.

How do you managing project financials? We use tools for accurate data entry and reporting. This also allows us to make informed decisions and ensure project profitability. It all comes down to carefully managing the financial aspect of the project.